I spent last weekend reading the new #MEV research from @Sei_Labs, and it completely resets how I think about L1 design.

MEV has already stripped more than $1.3B from Ethereum users, and #SEI GIGA is a good one to fix it.🧵

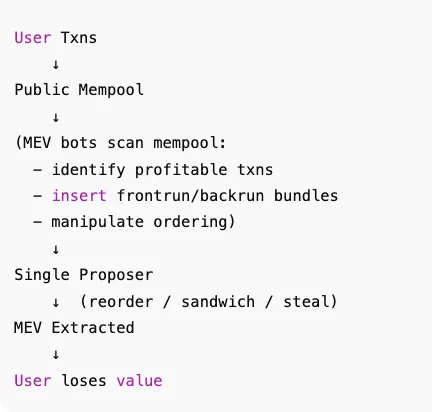

1/ To understand why #SEI’s approach is different, we need to look at where MEV actually appears.

MEV bots scan it, detect profitable opportunities, inject frontrun/backrun bundles, and manipulate ordering.

A single proposer then builds the block, reorders transactions, sandwiches, or steals value.

MEV gets extracted, and the user loses money.

#Sei Giga flips the old model with #MCP (Multiple Concurrent Proposers).

Instead of one proposer controlling the entire block, several proposers publish blocks in the same tick.

Here’s what that looks like in practice:

User transactions flow to

→ proposer A, Proposer B, Proposer C

→ each proposer builds its own block (Block A, Block B, Block C)

→ SEI Giga’s consensus merges them into a single final chain.

A parallel block pipeline replaces the single choke point that created classic MEV.

MCP introduces new MEV dynamics, tx stealing, proposer timing games, proposer-to-proposer auctions.

here’s the breakthrough:

Sei Labs formalized them and showed they are bounded.

Predictable MEV is fundamentally safer for users and markets.

Bounded MEV is exactly what high-volume systems need: perps, options, RWAs, credit markets, arbitrage engines.

You can’t build real financial infrastructure on top of unbounded extraction.

If Sei succeeds, the beneficiaries are the traders, the liquidity providers, and every user who interacts with real onchain markets.

MEV becomes contained instead of weaponized.

Market moves faster on $SEI. ($/acc)

17,86 mil

174

El contenido de esta página lo proporcionan terceros. A menos que se indique lo contrario, OKX no es el autor de los artículos citados y no reclama ningún derecho de autor sobre los materiales. El contenido se proporciona únicamente con fines informativos y no representa las opiniones de OKX. No pretende ser un respaldo de ningún tipo y no debe ser considerado como un consejo de inversión o una solicitud para comprar o vender activos digitales. En la medida en que la IA generativa se utiliza para proporcionar resúmenes u otra información, dicho contenido generado por IA puede ser inexacto o incoherente. Lee el artículo vinculado para obtener más detalles e información. OKX no es responsable del contenido alojado en sitios de terceros. El holding de activos digitales, incluyendo stablecoins y NFT, implican un alto grado de riesgo y pueden fluctuar en gran medida. Debes considerar cuidadosamente si el trading o holding de activos digitales es adecuado para ti a la luz de tu situación financiera.